Some tech workers have found ways to sidestep rules against selling their private company shares because plenty of third parties, who are desperate to own stock of high-valued start-ups like Uber and Airbnb, will buy the shares in transactions on the side. But as more Silicon Valley start-ups have delayed an initial public offering or sale, the companies have felt increasing pressure to return cash to employees. The young companies often give out stock to attract workers, who see the shares as a potentially rich payday when the start-up eventually goes public or gets sold. The move illustrates how Silicon Valley start-ups are honing their approaches to employee shares. While Airbnb has long had a blanket restriction preventing workers from selling or transferring shares, it recently detailed these rules point-by-point, these people said. In exchange, Airbnb employees had to agree to prohibitions on their remaining stock, including more categorical language that they could not trade or sell the shares, these people said. In July, the San Francisco-based company offered employees an opportunity to sell a percentage of their Airbnb stock as part of a deal that let investors buy those shares, according to two people who spoke on the condition of anonymity. This type of bargain was recently struck at Airbnb, the online room rental start-up.

So private companies such as Pinterest and SpaceX are increasingly arriving at the same solution: They are giving employees some controlled opportunities to sell their start-up shares - but in return, workers now must agree to more explicit restrictions on what they can and cannot do with their remaining stock. Many of their workers are compensated with lucrative piles of a start-up’s stock, but cannot cash it in because the shares do not trade publicly.

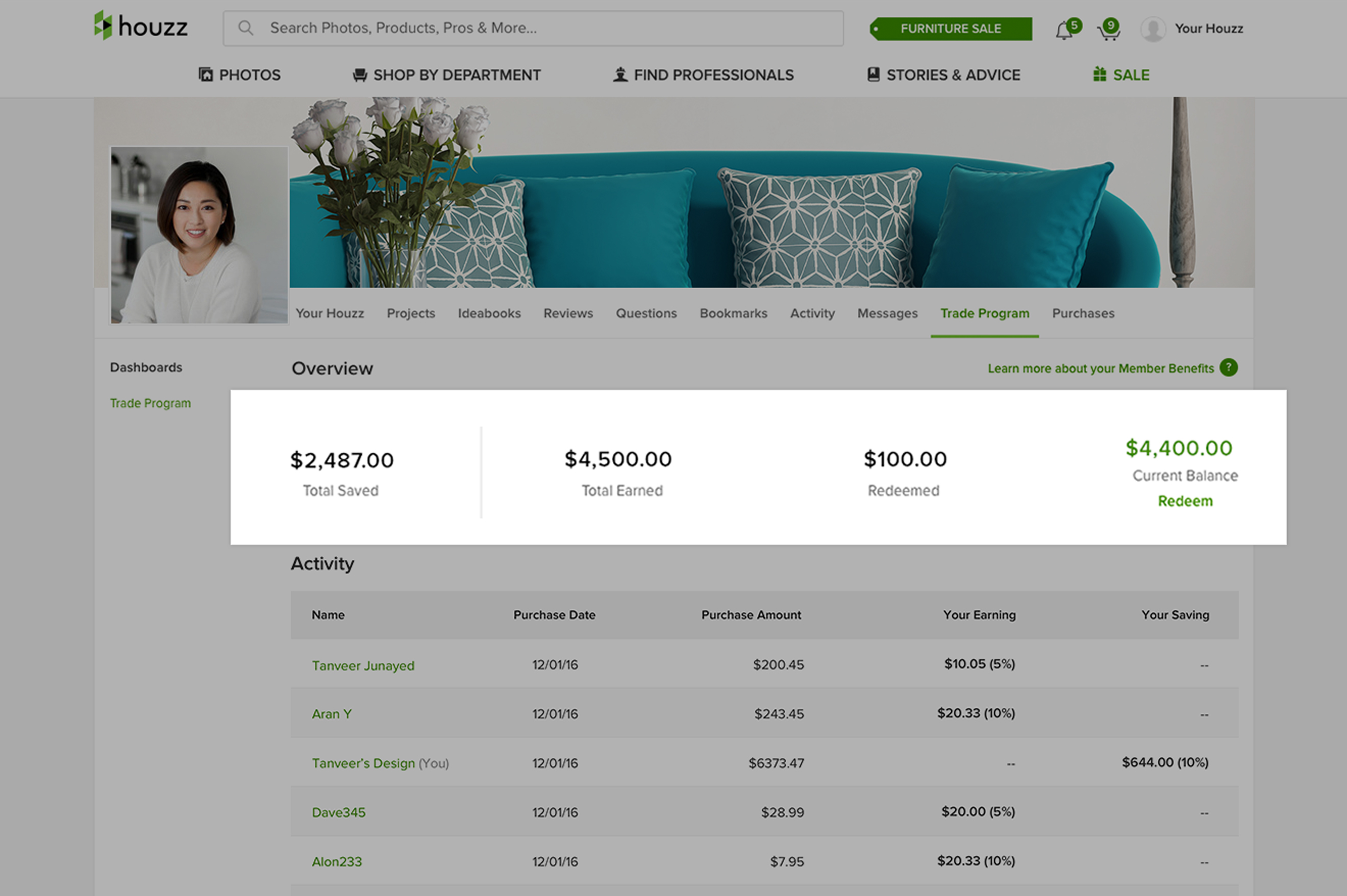

Houzz stock value how to#

All rights reserved.SAN FRANCISCO - Technology start-ups have long wrestled with a conundrum of how to reward their employees. Other trademarks are property of their respective owners. EquityZen and logo are trademarks of EquityZen Inc. By accessing this site and any pages thereof, you agree to be bound by our Terms of Use. Check the background of this firm on FINRA’s BrokerCheck.Į is a website operated by EquityZen Inc. EquityZen Securities is a broker/dealer registered with the Securities Exchange Commission and is a FINRA/ SIPC member firm.Įquity securities are offered through EquityZen Securities. See our Risk Factors for a more detailed explanation of the risks involved by investing through EquityZen’s platform.ĮquityZen Securities LLC (“EquityZen Securities”) is a subsidiary of EquityZen Inc. Investors must be able to afford the loss of their entire investment. Investing in private companies may be considered highly speculative and involves a high degree of risk, including the risk of substantial loss of investment. Investment opportunities posted on this website are "private placements" of securities that are not publicly traded, are subject to holding period requirements, and are intended for investors who do not need a liquid investment.

0 kommentar(er)

0 kommentar(er)